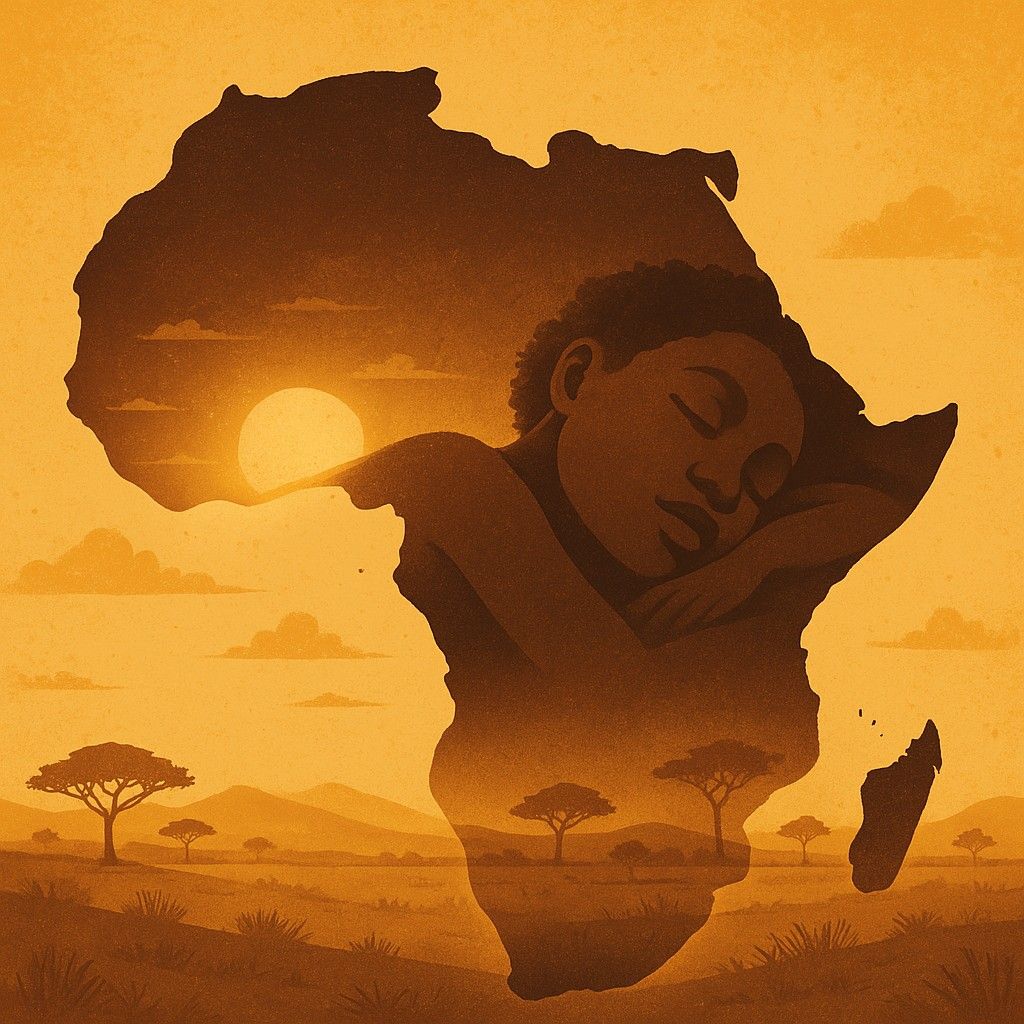

We stand beside an overflowing river, yet thirst. Africa pulses with a wealth so vast, so multidimensional, that its sheer potential hums beneath the soil, resonates in ancient languages, sparks in youthful eyes, and echoes in diaspora dreams.

Yet, generation after generation, this wealth remains curiously, tragically, unspent – not absent, but diverted, dormant, or systematically extracted. This is not a narrative of lack, but of latent power. The core question for our century is this: How do we shift from being a continent whose wealth is taken to one whose wealth is invested, intentionally and collectively, for our own flourishing?

I. The Historical Diversion: Severing the Roots of Accumulation

To understand the present, we must confront the brutal engineering of diversion. Pre-colonial African societies were not idyllic utopias of pure equity, but they possessed sophisticated systems for generating, managing, and circulating wealth. Think of the intricate gold weights of the Akan, symbolizing not just value but a philosophy of balanced exchange; the vast intellectual and commercial wealth of Timbuktu, anchored in scholarship and trans-Saharan trade; the regenerative agricultural practices embedded in countless cultures, ensuring land remained fertile for generations.

The transatlantic slave trade initiated the most profound theft of human capital the world has ever witnessed. It wasn’t merely the abduction of 12.5 million people; it was the extraction of their intellect, strength, creativity, and future descendants – a colossal, incalculable subtraction of potential. As historian Nathan Nunn’s work underscores, the regions most ravaged by the slave trade remain disproportionately impacted by poverty and instability centuries later – a stark testament to stolen generational wealth.

Colonialism perfected the extractive machinery. It wasn’t just about taking minerals or cash crops; it was about systematically dismantling indigenous economic structures and redirecting value flows. Colonial administrations imposed taxes payable only in cash, forcing Africans into wage labour on European-owned plantations or mines, effectively monetizing their labour for external benefit. Land, communally held and stewarded for centuries, was declared “vacant” or seized, privatized, and integrated into global commodity chains. Local industries were actively suppressed to create captive markets for manufactured goods from the metropole. Education, where it existed, was designed to create clerks and low-level functionaries, not innovators or critical thinkers challenging the system. The wealth generated – from cocoa in Ghana to copper in Katanga – flowed outward, building European cities and industries while leaving behind infrastructure designed solely for extraction, not holistic development. The infamous “Berlin borders,” arbitrarily carved with no regard for ethnic, linguistic, or economic realities, further fragmented potential markets and sowed seeds of future conflict, hindering the natural accumulation and circulation of intra-African wealth.

II. The Contemporary Leakage: Wealth Flowing, But Not Nourishing

Decolonization brought political flags, but the economic arteries often remained constricted or redirected. The promise of independence – to finally spend our wealth on ourselves – has been persistently undermined by old ghosts in new forms.

- Resource Curse as Persistent Theft: The Democratic Republic of Congo embodies this paradox. Holding an estimated $24 trillion in mineral wealth (cobalt critical for the global green revolution, coltan for our smartphones), its people remain among the world’s poorest. Illicit financial flows, facilitated by opaque contracts, tax evasion by multinationals, and corruption, hemorrhage an estimated $1-3 billion annually from the DRC alone. As former Finance Minister Ngozi Okonjo-Iweala has tirelessly documented globally, this “leakage” is systemic across resource-rich states. Nigeria, Africa’s largest oil producer, saw its external reserves dwindle precariously despite decades of petrodollars, a story of mismanagement and grand corruption where wealth is siphoned, not invested in diversification or human capital.

- The Human Capital Chokehold: Africa boasts the world’s youngest population – a potential demographic dividend of unprecedented scale. Yet, this wealth is stifled. Education systems, often underfunded and burdened by colonial curricula, struggle to equip youth with relevant skills. Unemployment and underemployment rates are staggering. The “brain drain” persists, with doctors, engineers, and tech talent seeking opportunities abroad – a direct export of vital human capital. In Kenya, vibrant tech hubs like Nairobi’s “Silicon Savannah” showcase incredible ingenuity, yet struggle to scale due to limited venture capital tailored for African realities and regulatory hurdles. The vast informal sector, representing up to 80% of employment in some countries, is a powerhouse of resilience and entrepreneurship (think Lagos’s bustling markets or Ghana’s “trotro” networks), but its potential is hamstrung by lack of access to finance, social protection, and formal recognition – its wealth remains largely untapped by the broader economy.

- Cultural Wealth Undervalued and Appropriated: Our languages, music, spirituality, art, and cosmologies are profound sources of wealth, offering alternative ways of knowing and being. Yet, they are often marginalized in formal education and governance. Worse, they are frequently mined for global profit without equitable return. Global music charts pulse with Afrobeats, yet intellectual property frameworks often fail to ensure fair compensation flows back to the source communities. Traditional ecological knowledge, like that championed by the late Wangari Maathai who linked environmental stewardship directly to community wealth and democracy, is rarely integrated into mainstream “development” models, leading to ecologically destructive practices. The spiritual resilience and communal philosophies embedded in African cultures represent a vast reservoir of social capital largely ignored in conventional economic planning.

- Diaspora Remittances: Lifeline, Not Launchpad: Diaspora remittances are a vital lifeline, exceeding $100 billion annually for Africa – surpassing Foreign Direct Investment (FDI) and Official Development Assistance (ODA). Countries like Ghana and Kenya rely heavily on them. Yet, this wealth is primarily spent on consumption and immediate needs (school fees, healthcare, basic sustenance), not strategic investment in businesses or infrastructure. Regulatory barriers, lack of trusted investment vehicles, and limited coordination between diaspora and homeland institutions mean this massive flow of capital rarely translates into transformative, productive investment. The intellectual capital, networks, and skills of the diaspora remain similarly under-leveraged.

III. Reimagining the Flow: An Afrofuturist Vision of Activated Wealth

Imagine an Africa where the river of wealth not only flows but nourishes the entire ecosystem. This is not mere fantasy; it is a vision grounded in emerging realities and ancestral wisdom, demanding audacious rethinking:

- Tech-Enabled Sovereignty: Beyond Silicon Savannah copycats, envision a continent leveraging AI designed for African languages, blockchain securing land titles and fighting corruption, and fintech unlocking capital within the massive informal sector. Imagine Ethiopian AI optimizing ancient water management systems, or Senegalese blockchain platforms ensuring fair compensation for Dakar’s fashion designers globally. Tech becomes a tool for capturing and circulating value within African networks.

- Regenerative Abundance: Moving beyond extractivism, wealth is built on restoring the land. Drawing deeply from Wangari Maathai’s legacy, imagine a continent leading the green revolution: vast solar farms powering industries, regenerative agriculture rebuilding soil and sequestering carbon (creating wealth through carbon credits), sustainable forestry managed by communities, and circular economies minimizing waste. The DRC’s rainforests become a global asset, generating wealth through preservation and sustainable bio-innovation, not just exploitation. Water, managed with ancient and modern wisdom, becomes a cornerstone of wealth and regional cooperation.

- Diaspora as Co-Architects: Remittances evolve from lifelines into strategic investment pools. Imagine diaspora bonds funding critical infrastructure, venture capital funds co-created by diaspora investors backing African startups, and knowledge networks systematically pairing diaspora experts with homeland institutions. Platforms emerge facilitating direct investment in community projects and small businesses, transforming emotional connection into tangible co-development. The diaspora becomes a powerful lobby for fairer global trade and investment rules.

- Cultural Renaissance as Economic Engine: African languages are revitalized in education and digital platforms. Cultural IP is fiercely protected and leveraged – imagine a pan-African digital streaming service owned by artists, or global franchises built around African mythology and design aesthetics, with royalties flowing back. Spirituality and communal values inform new economic models prioritizing well-being and social cohesion alongside profit. Tourism transforms into deep cultural exchange, owned and managed locally, valuing heritage over exploitation.

- Youth as the Transformative Current: The youth bulge becomes the ultimate competitive advantage. Education systems are radically overhauled, fostering critical thinking, creativity, and entrepreneurial skills aligned with African needs and opportunities. Incubators and accelerators proliferate. Young leaders, empowered with technology and a reclaimed sense of agency, drive innovation in governance, agriculture, manufacturing, and the arts. They are not job seekers, but wealth creators and system transformers.

IV. The Imperative Shift: Investing in Our Collective Capacity

This vision demands more than hope; it requires deliberate, systemic action:

- Reclaiming Economic Sovereignty: African governments must aggressively combat illicit financial flows through transparency (implementing the African Union’s Agenda 2063 benchmarks on governance), renegotiating unfair resource contracts, and strengthening tax administration. Regional bodies like AfCFTA must move beyond tariff reduction to harmonize regulations and foster real economic integration, creating massive internal markets for African goods and services.

- Investing in the Foundations: Prioritize transformative investment in education (especially STEM and critical thinking), healthcare (a healthy population is productive wealth), and infrastructure (especially digital and intra-African transport/energy networks). This requires not just public funds but innovative public-private partnerships and redirecting saved resources from plugging leakage.

- Unlocking the Informal Sector: Formalize by recognizing, protecting, and empowering – providing access to credit, skills training, social safety nets, and simplified regulatory pathways that respect the sector’s dynamism, not crush it.

- Harnessing the Diaspora Strategically: Governments and private sectors must create attractive, transparent investment vehicles and actively engage diaspora expertise. Simplify processes for dual citizenship, voting, and property ownership. Build platforms for meaningful connection beyond remittance apps.

- Cultural Policy as Economic Policy: Enact robust intellectual property protections for traditional knowledge and cultural expressions. Integrate cultural education and indigenous knowledge systems into national curricula and development planning. Support creative industries as serious economic sectors.

- Elevating African-Led Solutions: Shift funding and recognition towards African researchers, entrepreneurs, institutions, and civil society organizations driving context-specific solutions. Move beyond the donor-recipient paradigm to partnerships of equals.

- The Stewards Are Already Here: Look to the women’s cooperatives reviving sustainable farming in Malawi; the tech founders in Lagos and Kigali building global solutions; the musicians like Burna Boy and Angelique Kidjo fiercely asserting African artistic ownership; the activists demanding transparency like Nigeria’s BudgIT; the diaspora investors funding startups through platforms like Samurai Incubate Africa or Partech Africa; the community leaders integrating tradition with modern ecological stewardship. They are the architects of the new flow.

A Call to Conscience and Capital:

The wealth in Africans not spent is the defining challenge and opportunity of our time. It is a call to mend the leaks in our collective vessel. It demands courage from leaders to dismantle systems of extraction and corruption. It demands innovation from entrepreneurs to build inclusive, sustainable businesses. It demands engagement from the diaspora to invest not just money, but time, talent, and networks. It demands a global reckoning with the historical and ongoing structures that facilitate the outflow of African wealth.

We are not poor. We are rich beyond measure, yet our riches have too often been spent elsewhere. The task now is to turn inward, to reclaim, redirect, and intentionally invest our vast human, natural, cultural, and economic wealth. To finally spend it on ourselves – on our children, our lands, our cultures, our shared African future. This is not charity; it is the deepest act of self-preservation and the ultimate realization of our stolen legacy. The river is ours. Let us drink deeply, and let its waters nourish the world we are destined to build. The time for spending our own wealth, wisely and boldly, is now.